|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding VA Streamline Refinance Rates: A Comprehensive GuideThe VA Streamline Refinance, also known as the Interest Rate Reduction Refinance Loan (IRRRL), is a popular option for veterans looking to take advantage of lower interest rates. This process is designed to be simple, requiring minimal paperwork and no appraisal in most cases. What is a VA Streamline Refinance?The VA Streamline Refinance is a program that allows veterans to refinance their existing VA loan into a new VA loan with a lower interest rate. The key benefits include no appraisal or income verification in many cases, making it a fast and efficient option. Eligibility Requirements

Current VA Streamline Refinance RatesAs of now, VA streamline refinance rates are generally lower than conventional refinance rates. However, rates can vary based on market conditions and lender policies. Factors Influencing Rates

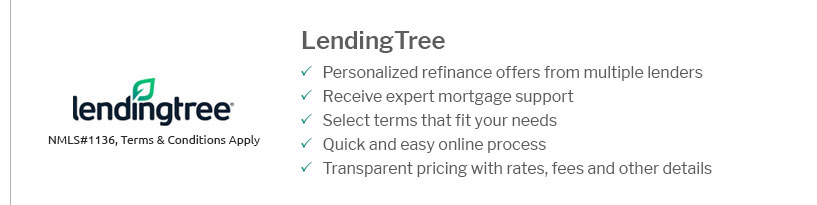

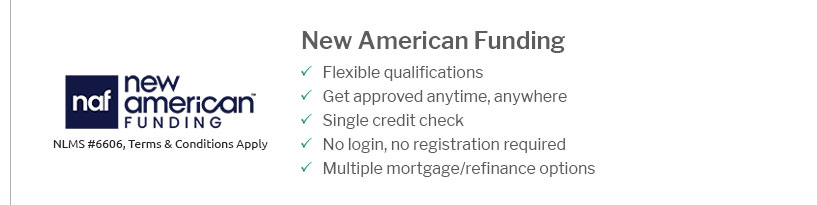

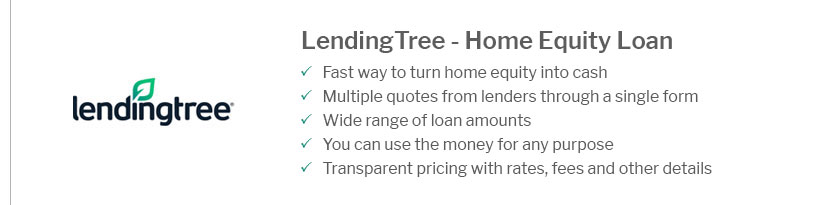

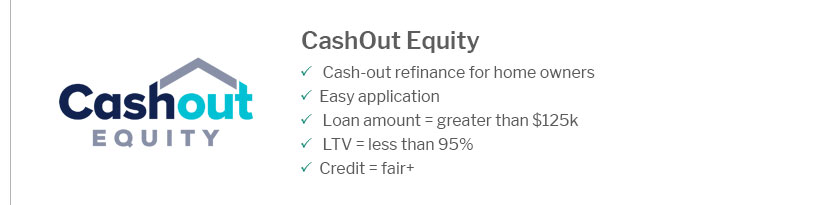

To compare the latest rates and find the best home refinance offers, visit home refinance offers. Benefits of VA Streamline RefinanceThe primary advantage is the ability to reduce your monthly payment by securing a lower interest rate. Other benefits include:

Potential DrawbacksWhile there are significant benefits, it's important to consider the potential drawbacks:

Before proceeding, ensure you weigh these factors and consider consulting a financial advisor. Steps to Apply for a VA Streamline Refinance

For a streamlined process, consider utilizing online platforms to apply for mortgage loan options. Frequently Asked QuestionsHow long does a VA Streamline Refinance take?Typically, the process can take between 30 to 45 days, depending on the lender's efficiency and your preparedness. Can I get cash back with a VA Streamline Refinance?No, the VA Streamline Refinance does not allow for cash-back options; it is purely for reducing interest rates. Is an appraisal required for a VA Streamline Refinance?In most cases, an appraisal is not required, simplifying the refinance process significantly. https://citycreekmortgage.com/refinance/va-refinance/

Lower Interest Rates - Convert from Adjustable to Fixed Rate - Flexible Credit Requirements - Finance Closing Costs - Cash-Out Option - Streamlined Process ... https://www.pennymac.com/refinancing-products/va-irrrl-streamline-refinance

An IRRRL can help a VA borrower reduce their monthly payments by replacing their current loan and refinancing at a lower interest rate. https://www.freedommortgage.com/va-loans-streamline

VA IRRRL refinancing makes it easier to lower your interest rate with less paperwork and faster closings. IRRRL stands for Interest Rate Reduction Refinance ...

|

|---|